This tax filing season has brought attention to the importance of understanding the relationship between your paycheck and your withholding. Some are receiving unpleasant surprises when they file their tax returns, discovering that they will get a smaller refund than last year or, worse, that they owe money to the IRS!

The reasons behind these unhappy surprises are varied, but most can be remedied by learning to understand and take charge of your paycheck withholding.

The IRS has a pay as you go system for collecting taxes. This means that you need to be paying part of your total tax liability every month (or every quarter if you are self-employed) and to pay at least 90% of that total liability by the time you file your taxes in order to avoid a penalty. If you end up paying more than you owe through paycheck withholding or through estimated taxes, the IRS refunds the difference back to you.

So how do you know if you are withholding enough to avoid a penalty or to make sure you have a refund waiting for you next April?

Use the IRS withholding calculator as a guide.

Ignore the worksheet and claim zero allowances on your w-4 and send in estimated tax payments on any income you receive that does not come from your paycheck.

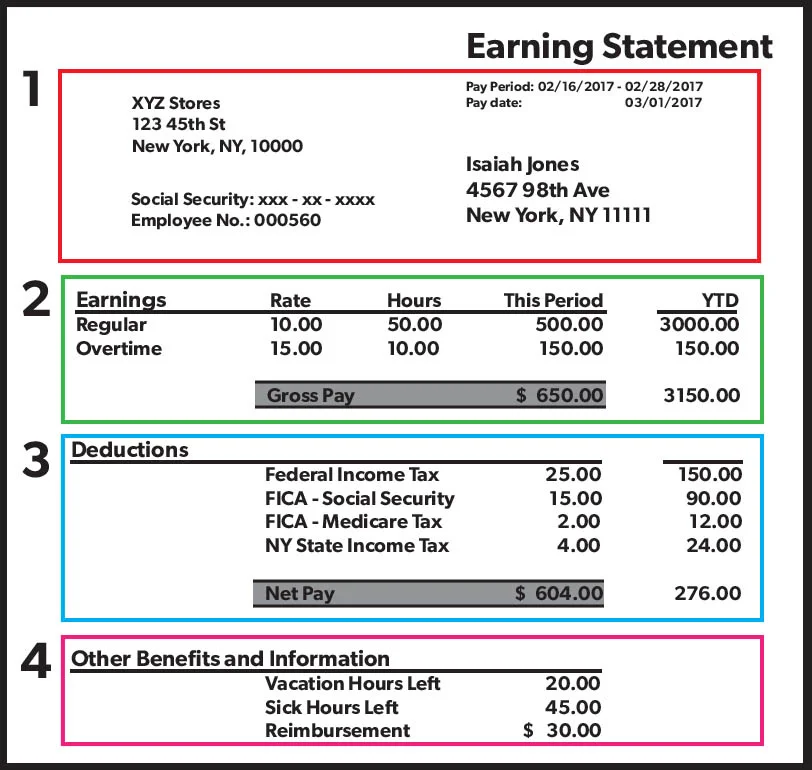

Take a close look at your own pay statement and figure it out for yourself:

Know how many times you get paid in a year

Monthly = 12 paychecks per year

Bi-monthly = 24 paychecks per year

Bi-weekly = 26 paychecks per year (in my experience this is the most common pay cycle)

Calculate how many more pay checks you will get until the end of the year.

Figure out how much you have been paid so far (Year To Date)

Figure out how much has been withheld for taxes so far this year

Figure out how much you will be paid from this paycheck until the end of the year by multiplying the earnings for this period times the number of pay periods you have left in the year.

Figure out how much total withholding will be taken out by multiplying the amount withheld from this paycheck times the number of pay periods remaining.

Compare your expected earnings and expected withholding to the tax tables for the year.

If you find that you are not having enough withheld, take steps to update your w-4 form with your employer.

At first it may seem complicated, but if you spend time studying the items on your pay statement, you will be better informed about your income, your deductions and your taxes. You can compare your own calculations to the IRS withholding calculator and feel empowered to take charge of your pay stub!

Jennipher Lommen is a Certified Financial Planner TM and Enrolled Agent who offers comprehensive financial planning and tax advice to clients in Santa Cruz, CA and beyond.